Many millennials were either just starting our careers or still in school in 2008, and now we’re older, with more complicated lives and the additional bank accounts to match. Many of us have kids and mortgages now, or small businesses with employees we’ve had to lay off — or both. Once again, we’re faced with a truly scary time. We’re afraid for our health and the wellbeing of the people we love. We’re scared and shocked when we watch the news. And isolating ourselves leaves us alone with our thoughts.

No one can control what’s going on right now, and we certainly can’t control the economic implications, either. Friends and clients have opened up to me about their financial fears. We’ve spent the last decade putting money away for retirement, and now those nest eggs are declining in value. What can we do in a time of market volatility?

Stop looking at your investment account balances

Seriously. Stop it. I know you have a bunch of apps that give you real-time data, but those alerts do nothing but stress you out and cause you to make investing decisions that aren’t in your best interest.

Here’s the thing with market volatility: It sucks in the short term (which is why I don’t recommend investing money you’ll need in the next five years). However, when you look at market performance over the long term, those periods of volatility smooth out.

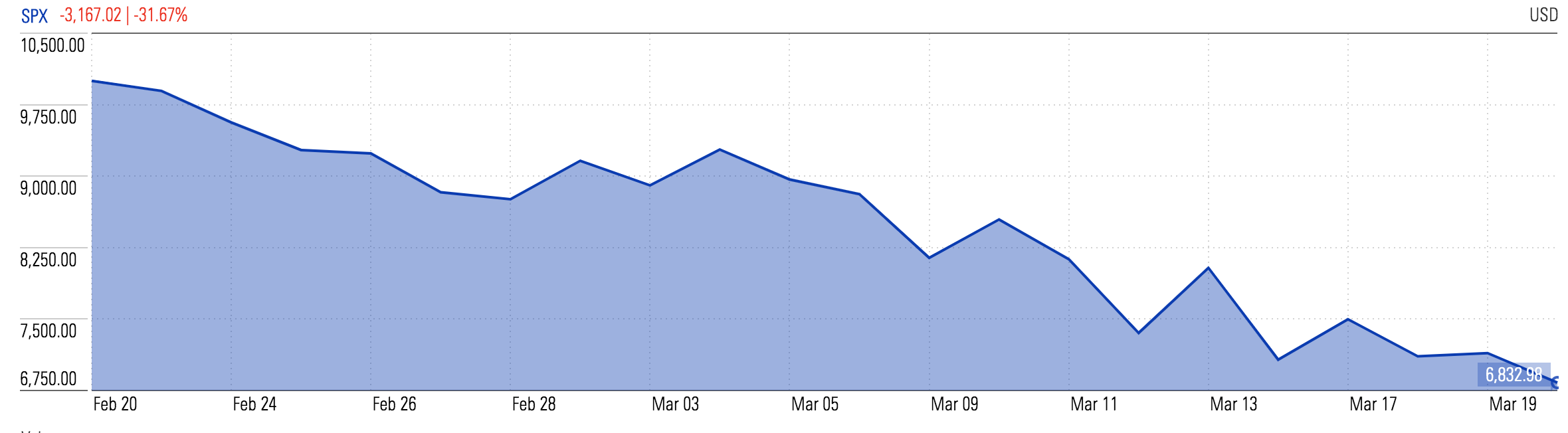

Here’s how the S&P 500 performed over the past month:

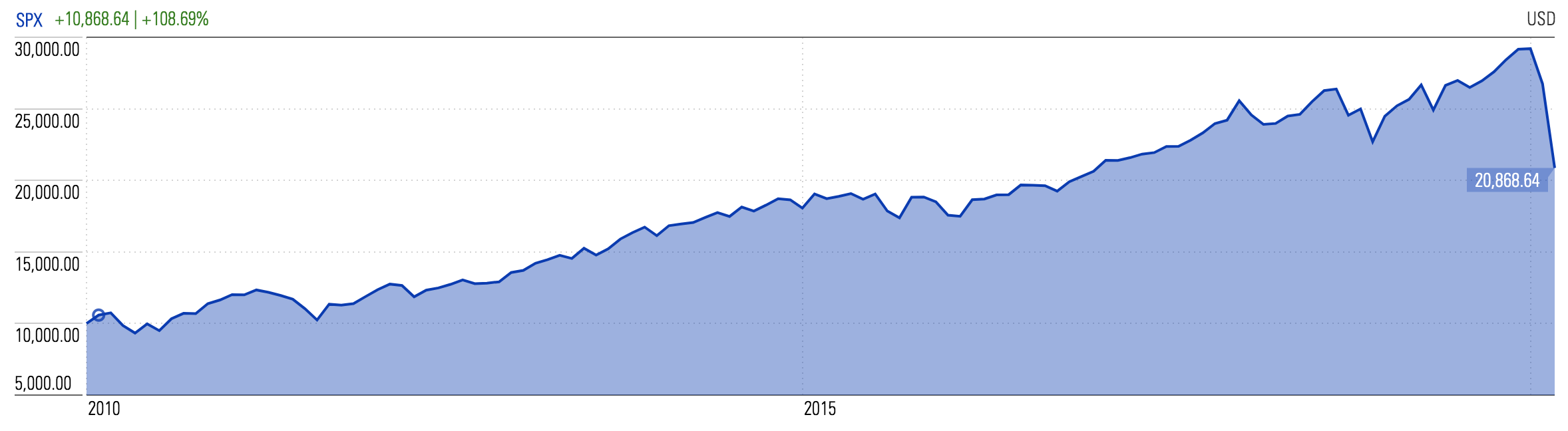

Scary, right? But what happens if you zoom out and look at the S&P 500 over the past 10 years?

Feeling better? I hope so! If anything, this goes to show you how a long investing time horizon can help with all the short-term twists and turns.

If your budget allows, keep investing

If you still have a reliable source of income and you’re able to afford to cover your bills and save for short-term goals, keep on investing with the money you have left over. Contributing to your employer-sponsored pre-tax retirement account (like 401(k)s, 403(b)s, and TSPs) helps you in two ways: it lowers your taxable income, and the employer match is free money. Keep putting in enough to get the full employer match, and if you have more funds available after that, contribute to a Roth IRA (if you qualify).

Making small, regular contributions means you’re dollar cost averaging into the market. By regularly buying shares at different price points as time goes on, you will generally end up buying shares at a lower price on average (compared to trying to time the market).

If your job is stable and your financial situation seems like it will remain the same regardless of what’s going on, try to max out your retirement contributions — or at least invest as much as you can. The maximum contribution for 401(k)s in 2020 is $19,500, and the max for Roth IRAs is $6,000.

Side note: since the 2019 tax deadline has been extended to July 15, 2020, you also have until this date to make contributions to your 2019 IRAs, Roth IRAs, and HSAs, so if you have the resources, do this first before making 2020 contributions to these accounts.

Stick to your plan, but adjust as needed

If you still have decades before you retire, don’t make hasty changes to your long-term plan. Where you may need to adjust is in the short term. This could mean lowering your savings or retirement contributions to have more cash on hand to pay the bills, or it might mean delaying a major purchase like buying a car or completing a home renovation.

If right now you’re struggling financially, do what it takes to get through the day-to-day. Prioritize making at least the minimum payments on your debts, and reach out to your lender if you’re struggling to make a specific payment. If you do have savings, now might be when you need to dip into them to pay off your credit card in full and avoid paying interest.

Don’t forget to take care of yourself

The world is collectively grieving right now. It’s very strange to experience suffering on a global level. Everyone is feeling the stress right now, so do what you can to take care of yourself during this time. Be gentle with yourself and others. We all have to do our part.

There are lots of free ways to keep your spirits up — take a walk, work out at home, read, watch a live streaming concert, practice an instrument, or catch up with a friend on a video call. Focus on your health and safety. That’s always a good investment.